Auto insurance is a necessity that every vehicle owner in Arkansas should be aware of. Rates are not always the same for every vehicle, especially when comparing trucks and cars. Many drivers wonder why premiums can differ so much and how to find the best rate. It is essential to understand what factors affect your insurance costs before making a decision. By comparing rates for trucks and cars, Arkansas drivers can make more informed choices that align with their budget and needs. This article examines how insurance rates are determined and provides tips for reducing your policy costs. With the correct information, you can protect your vehicle and your wallet.

Understanding Auto Insurance Basics in Arkansas

Arkansas requires auto insurance by law for all drivers. The state sets minimum liability coverage to make sure everyone on the road is protected. Liability insurance covers damage or injury to others if you are at fault in an accident. Many drivers also choose to add coverage for damage to their vehicle, such as collision or comprehensive insurance. Different types of vehicles, such as trucks and cars, may require varying levels of coverage depending on their usage and value. Understanding the basics of auto insurance helps you comprehend your policy and its coverage.

Insurance companies in Arkansas consider several factors when determining your rates. They verify your age, driving record, and address. The type of car or truck you drive is also a significant factor. Some vehicles are more expensive to repair or replace, which may result in higher premiums. Insurance is there to protect you and others, but it also helps you follow the law. Every Arkansas driver should know what is required and what extra coverage might be helpful.

Choosing the right coverage can make a big difference in your peace of mind. Arkansas offers many options for drivers of cars and trucks. You can choose higher limits or add extra coverage, such as uninsured motorist coverage or medical payments coverage. Consulting with a local agent can help you find the best solution for your specific situation. Shopping around makes it easier to get the coverage you need at a price you can afford. Knowing the basics is the first step in finding the right auto insurance for your vehicle, whether it’s a car or a truck.

Key Factors Impacting Insurance Rates for Vehicles

Several key factors can influence the cost of auto insurance in Arkansas. Your driving record is one of the most important factors companies consider. Safe drivers are usually rewarded with lower rates, while tickets or accidents can raise your premium. Your age and experience behind the wheel can also play a significant role. Younger drivers tend to pay more, as carriers consider them a higher risk of loss.

Where you live in Arkansas may also affect your insurance costs. Urban areas with higher traffic volumes often see higher premiums due to a greater likelihood of accidents. Rural areas can sometimes have lower rates, but they may face other risks, such as wildlife collisions. The type of vehicle you own, whether a truck or a car, also affects your rate. Trucks are sometimes viewed as work vehicles, which can influence how companies assess risk.

The way you use your vehicle also makes a difference. If you use your truck for business or heavy hauling, that can increase your insurance cost. Cars used primarily for commuting or family trips might have lower premiums. The carrier also takes into consideration the safety features and value of your vehicle. More expensive cars or those without advanced safety features may be more costly to insure. All these factors work together to determine your final rate.

Comparing Insurance Costs for Trucks and Cars

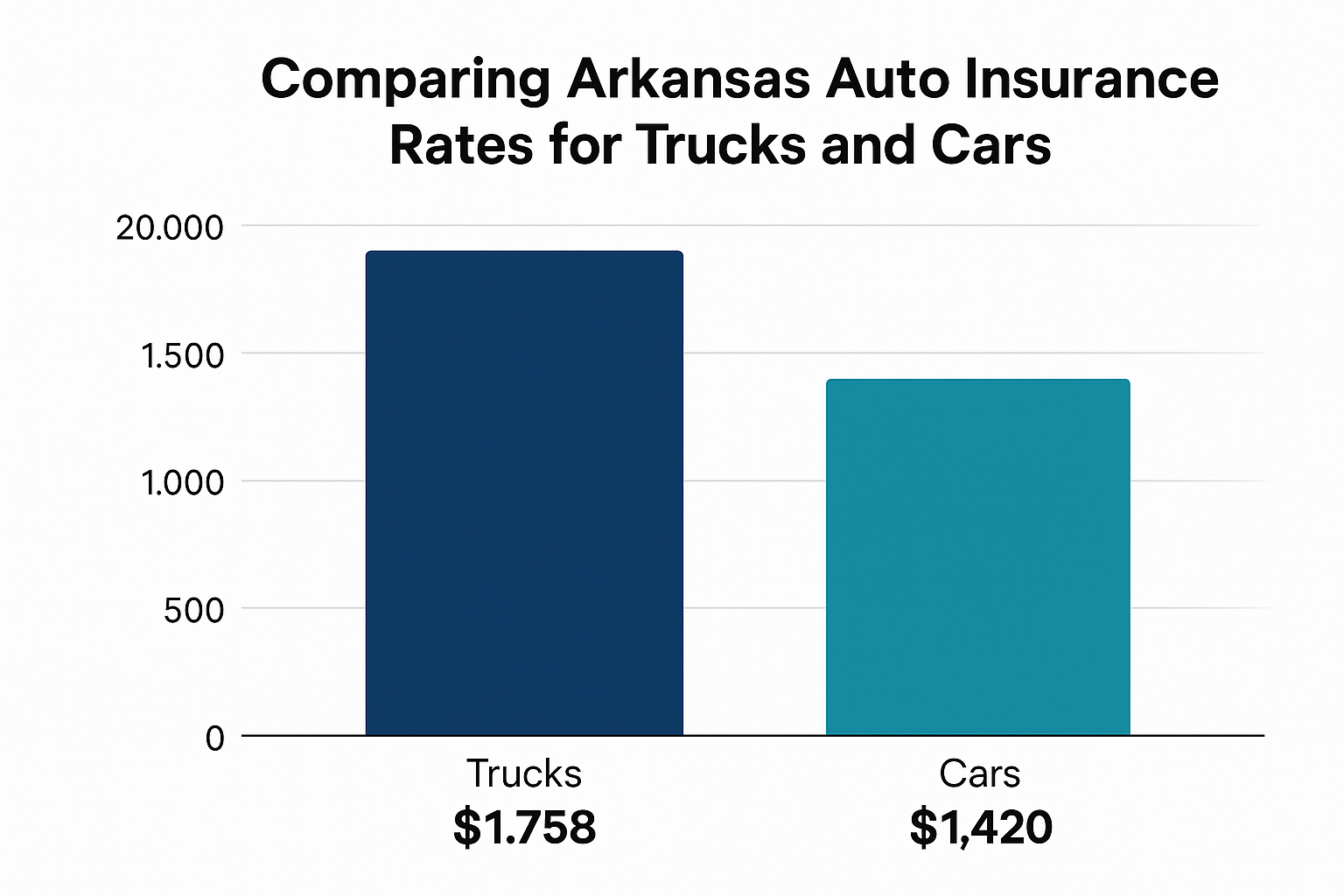

Insurance rates for trucks and cars in Arkansas can vary significantly. Many people believe that trucks are always more expensive, but that is not always the case. The specific make, model, and year of your vehicle are essential. Manufacturers produce trucks designed for heavy-duty work. However, they engineer others for comfort and family use. Cars often have different safety ratings and repair costs, which can change your premium.

While trucks can sometimes be more expensive to insure, they may also come with features that lower your rate. For example, trucks with strong safety records or advanced security systems can cost less to insure. Cars with a high theft rate or those equipped with expensive parts may be subject to higher premiums. Insurance companies consider the frequency of vehicle thefts and accidents. Trucks and cars are rated differently based on this data.

Comparing quotes from different companies is smart for any Arkansas driver. Rates can vary widely between insurers, even for the exact vehicle. Some companies specialize in insuring trucks, while others focus on cars. Shopping around and asking questions about what affects your rate will help you find the best deal. Always compare the same coverage levels to ensure a fair comparison.

Why Trucks May Cost More or Less to Insure

Trucks may be more expensive to insure in Arkansas if the owner uses them for work or towing purposes. Heavy use can lead to increased wear and tear, thereby increasing the likelihood of accidents or claims. Trucks that are larger or have more powerful engines may be involved in more severe accidents, which can lead to higher premiums. Insurance companies consider the potential for damage and the cost of repairing or replacing a truck when setting rates.

On the other hand, some trucks cost less to insure than certain cars. Trucks with good safety ratings or low repair costs can get better rates. Engineers build most trucks to withstand greater impact, which can reduce damage in the event of an accident. Trucks that are not used for business and have clean records may also be cheaper to insure. Insurance companies reward vehicles that are less risky to cover.

The value and popularity of a truck can significantly impact your rate. High-end trucks with expensive features may have higher premiums. However, if a car is less likely to be stolen or is easy to repair, your insurance could be lower. Comparing rates for several different trucks and vehicles will help you determine which one offers the best value for your budget. Every truck and car is unique, so it pays to examine the details.

Tips for Lowering Your Auto Insurance Premiums

There are several ways to save money on your Arkansas auto insurance. Keeping a clean driving record is one of the best things you can do. Safe drivers who avoid tickets and accidents often get the lowest rates. Taking a defensive driving course can also lower your premium. Some insurers offer discounts for drivers who complete approved safety programs.

Bundling your auto insurance with other policies, like home or renters insurance, can sometimes save you money. Many companies give discounts to customers who have more than one policy with them. Choosing a higher deductible is another way to lower your monthly payments. Just be sure you can afford to pay the deductible if you ever need to file a claim.

Asking about discounts is always a good idea. Many Arkansas insurance companies offer savings for activities such as maintaining good grades, installing anti-theft devices, or driving fewer miles each year. Shopping around and comparing quotes from several insurers is one of the best ways to find a lower rate. Each company weighs risk differently, so that the same driver might receive different quotes for the same coverage. Reviewing your policy annually and updating your information can also help you secure the best deal.

Making the Best Choice for Your Vehicle Insurance

Choosing the right insurance for your truck or car in Arkansas takes some research. Start by considering how you use your vehicle and what coverage you truly need. Trucks and cars can have different risks, so your policy should reflect your driving habits and needs. Comparing rates and coverage options from multiple companies will help you make an informed choice. Do not hesitate to ask questions or request additional information from agents.

Working with a local agent can be beneficial, especially if you require guidance on selecting the most suitable policy for your specific situation. Local agents are familiar with Arkansas laws and may be aware of regional discounts or special programs. Always ensure your coverage meets state requirements, but consider adding extra protection if you drive frequently or own a new or valuable vehicle. Reviewing your policy each year is important because your needs can change over time.

Getting the right insurance gives you peace of mind on Arkansas roads. You will know you have protected yourself in the event of an accident, and you can avoid costly fines or legal trouble. Taking your time to compare rates and coverage pays off in the long run. Ensure you understand what the carrier includes in your policy and explore ways to reduce your costs. Choosing the right plan for your truck or car helps you stay safe and keeps your hard-earned money in your pocket.

Conclusion

Comparing auto insurance rates for trucks and cars in Arkansas is an essential step for every driver. Understanding what affects your premium helps you make better decisions about your coverage. Please note that rates can vary significantly depending on your driving record, vehicle usage, and location. Trucks and cars each have unique factors that can change your insurance cost. Taking time to compare options from different companies gives you more control over your budget. Looking for discounts and maintaining a clean record can also lead to significant savings. Be sure to review your policy annually and update it as your needs change. Local agents can offer guidance and help you find the right plan. The insurance you choose should provide you with peace of mind and align with your lifestyle. By staying informed and comparing your options, you can see the best value and protection for any car or truck you drive in Arkansas.